Using Disaster Surveys to Model Business Interruption

Abstract

Introduction

Previous Empirical Research

| Study using survey data | Analysis method | Dependent variable | Damage variables | Utility variables | or pseudo- | Other included variable categoriesa |

|---|---|---|---|---|---|---|

| Orhan (2014) | Summary statistics | Closure (Y/N) | Destruction of building (Y/N), needing to clear out damaged contents (Y/N), need to have building structurally assessed (Y/N), loss of machinery (Y/N), loss of inventory or stock (Y/N) | Lifeline losses (Y/N) | N/A | Business characteristics, ownership characteristics, financial capital, customers, labor, transportation |

| Tierney and Nigg (1995) and Tierney (1995) | Summary statistics | Closure (Y/N) | Building flooded (Y/N), loss of machinery or equipment (Y/N), loss of inventory (Y/N) | Loss of water (Y/N), loss of electricity (Y/N), loss of natural gas (Y/N), loss of water treatment (Y/N), loss of phone service (Y/N) | N/A | Customers, labor, supply, transportation |

| Asgary et al. (2012) | Chi-squared test, correlation | Time to reopen (multiple month intervals) | Level of facility damage (none, minimal, some, significant, total); level of inventory damage (none, minimal, some, significant, total) | Dependence on electricity (Y/N), dependence on water (Y/N), Dependence on transportation (Y/N); lifeline damage (level) | N/A | Business characteristics, ownership characteristics, financial capital, risk perception or disaster experience, recovery perception, labor, social capital |

| Flott (1997) | Chi-squared test | Time to reopen (less than 1 month versus more than 1 month) | Level of damage (none, little, major) | N/A | N/A | Business characteristics, financial capital, social capital |

| Khan and Sayem (2013) | Logistic regression | Reopened (Y/N); time taken to reopen (1 = more than 1 week) | Machinery or tool loss (Y/N) | Level of electricity supply (hours per day) | Not reported | Business characteristics, ownership characteristics, financial capital, risk perception or disaster experience, recovery perception, customers, labor, supply |

| Sultana et al. (2018) | Regression, random forest model | Interruption duration (days) | Water level (centimeters), inundation duration (hours) | N/A | 0.053 | Business characteristics, government response, site characteristics, risk perception or disaster experience, resources, adaptation, customers, supply |

| Wasileski et al. (2011) | Logistic regression | Temporary closure (Y/N) | Level of disruptiveness of building damage (0–4); level of contents damage (0–5); structure type (wood frame, unreinforced masonry, stronger structure, or other) | Level of disruptiveness of electricity, phone, water, sewer, transportation (0–4) | 0.118 and 0.087 | Business characteristics, ownership characteristics, resources, customers, labor, transportation |

| Yang et al. (2016) | Functional fragility curves and accelerated failure time models | Drop ratio, stagnation time, recovery time | Damage state (DS0–DS3) | N/A | Not reported | Business characteristics |

Research Design

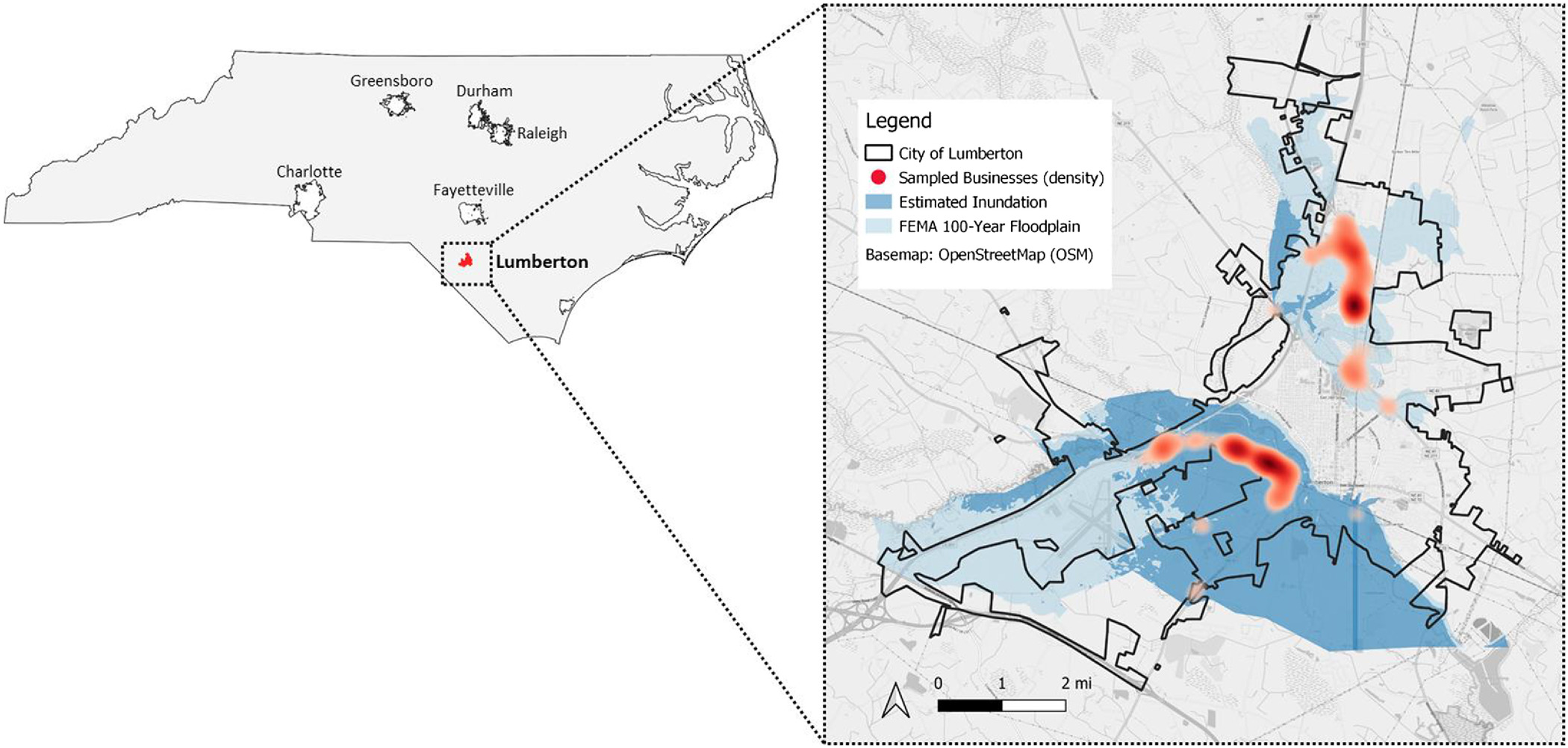

Study Site

Sample and Data Collection

Analytical Methods

Findings

Descriptive Statistics

| Variable | Observationsa | Meanb | Standard deviationb | Min | Max |

|---|---|---|---|---|---|

| Dependent variables | |||||

| Business interruption (days) | 163 | 17.50 | 38.14 | 0 | 300 |

| Business interruption (log days) | 163 | 2.35 | 1.36 | 0 | 5.71 |

| Open at 1 week (1 = yes, 0 = no) | 163 | 0.45 | 0.50 | 0 | 1 |

| Open at 2 weeks (1 = yes, 0 = no) | 163 | 0.71 | 0.46 | 0 | 1 |

| Open at 3 weeks (1 = yes, 0 = no) | 163 | 0.81 | 0.39 | 0 | 1 |

| Open at 4 weeks (1 = yes, 0 = no) | 163 | 0.85 | 0.35 | 0 | 1 |

| Open at 5 weeks (1 = yes, 0 = no) | 163 | 0.90 | 0.30 | 0 | 1 |

| Open at 6 weeks (1 = yes, 0 = no) | 163 | 0.91 | 0.29 | 0 | 1 |

| Damage | |||||

| Building damage: (1 = yes, 0 = no) | 162 | 0.36 | 0.48 | 0 | 1 |

| Content damage: (1 = yes, 0 = no) | 162 | 0.41 | 0.49 | 0 | 1 |

| Machinery or equipment damage: (1 = yes, 0 = no) | 161 | 0.15 | 0.35 | 0 | 1 |

| Building damage (%) | 162 | 16.62 | 34.59 | 0 | 100 |

| Content damage (%) | 162 | 28.25 | 41.09 | 0 | 100 |

| Machinery or equipment damage: (%) | 161 | 10.13 | 26.79 | 0 | 100 |

| Utility disruptions | |||||

| Electricity loss (1 = yes, 0 = no) | 161 | 0.98 | 0.14 | 0 | 1 |

| Water loss (1 = yes, 0 = no) | 161 | 0.91 | 0.28 | 0 | 1 |

| Natural gas loss (1 = yes, 0 = no) | 149 | 0.08 | 0.27 | 0 | 1 |

| Sewer loss (1 = yes, 0 = no) | 153 | 0.36 | 0.48 | 0 | 1 |

| Cell phone service loss (1 = yes, 0 = no) | 158 | 0.30 | 0.46 | 0 | 1 |

| Electricity loss (log days) | 158 | 1.85 | 0.68 | 0 | 5.20 |

| Water loss (log days) | 154 | 2.18 | 0.94 | 0 | 5.20 |

| Natural gas loss (log days) | 148 | 0.20 | 0.79 | 0 | 5.90 |

| Sewer loss (log days) | 146 | 0.83 | 1.37 | 0 | 6.17 |

| Cell phone service loss (log days) | 160 | 0.50 | 0.95 | 0 | 5.48 |

| Transportation disruption | |||||

| Accessibility problem (i.e., street or sidewalk closure): (1 = yes, 0 = no) | 153 | 0.48 | 0.50 | 0 | 1 |

| Customer issues | |||||

| Lost customers (1 = yes, 0 = no) | 161 | 0.61 | 22.92 | 0 | 1 |

| Employee issues | |||||

| Employee home repair problem: (1 = yes, 0 = no) | 154 | 0.51 | 0.50 | 0 | 1 |

| Employee childcare or school problems: (1 = yes, 0 = no) | 157 | 0.25 | 0.43 | 0 | 1 |

| Employee physical or mental health problems: (1 = yes, 0 = no) | 156 | 0.07 | 0.25 | 0 | 1 |

| Business characteristics | |||||

| Branch: (1 = yes, 0 = no) | 164 | 0.41 | 0.49 | 0 | 1 |

| Manufacturing or construction sector: (1 = yes, 0 = no) | 164 | 0.07 | 0.26 | 0 | 1 |

| Retail or wholesale sector: (1 = yes, 0 = no) | 164 | 0.39 | 0.49 | 0 | 1 |

| Number of part- and full-time employees before Hurricane Matthew | 163 | 16.20 | 26.91 | 1 | 250 |

| Rents premises: (1 = yes, 0 = no) | 161 | 0.56 | 0.50 | 0 | 1 |

| Business owner or manager profile | |||||

| Race or ethnicity other than non-Hispanic White: (1 = yes, 0 = no) | 159 | 0.39 | 0.49 | 0 | 1 |

| Years of experience | 158 | 15.85 | 12.43 | 0.02 | 70 |

| Insurance coverage | |||||

| Had building insurance: (1 = yes, 0 = no) | 121 | 0.65 | 0.48 | 0 | 1 |

| Had contents insurance: (1 = yes, 0 = no) | 125 | 0.58 | 0.50 | 0 | 1 |

| Had interruption insurance: (1 = yes, 0 = no) | 113 | 0.34 | 0.47 | 0 | 1 |

Variable Inclusion Considerations

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 |

|---|---|---|---|---|---|---|---|---|---|

| Coefficient | Coefficient | Coefficient | Coefficient | Coefficient | Coefficient | Coefficient | Coefficient | Coefficient | |

| Constant | 1.522 | 1.692 | 1.552*** | 1.487*** | 2.243*** | 2.229*** | 1.715*** | 2.141*** | 1.283 |

| Damage indicator | |||||||||

| Building (1/0) | 0.151*** | — | — | — | — | — | — | — | 0.153 |

| Contents (1/0) | 0.705*** | — | — | — | — | — | — | — | 0.507** |

| Machinery (1/0) | 1.283*** | — | — | — | — | — | — | — | 0.980*** |

| Utility loss indicator | |||||||||

| Electricity (1/0) | — | — | — | — | — | — | — | ||

| Water (1/0) | — | 0.187 | — | — | — | — | — | — | |

| Gas (1/0) | — | 1.781*** | — | — | — | — | — | — | 1.092*** |

| Sewer (1/0) | — | 0.158 | — | — | — | — | — | — | |

| Cell phone (1/0) | — | — | — | — | — | — | — | ||

| Transportation disruption | |||||||||

| Access | — | — | 1.134*** | — | — | — | — | — | 0.498** |

| Customer issues | |||||||||

| Customers | — | — | — | 0.748*** | — | — | — | — | 0.591*** |

| Employee issues | |||||||||

| Home damage | — | — | — | — | — | — | — | — | |

| Childcare or school | — | — | — | — | 0.078 | — | — | — | — |

| Health | — | — | — | — | 0.882 | — | — | — | — |

| Business characteristics | |||||||||

| Branch | — | — | — | — | — | — | — | — | |

| Manufacturing or construction | — | — | — | — | — | — | — | — | |

| Retail | — | — | — | — | — | — | — | — | |

| No. of employees | — | — | — | — | — | 0.001 | — | — | — |

| Renter | — | — | — | — | — | — | — | — | |

| Owner or manager profile | |||||||||

| Race | — | — | — | — | — | — | 0.235 | — | — |

| Experience | — | — | — | — | — | — | 0.014 | — | — |

| Insurance coverage | |||||||||

| Building | — | — | — | — | — | — | — | 0.256 | — |

| Contents | — | — | — | — | — | — | — | — | |

| Interruption | — | — | — | — | — | — | — | — | |

| 20.79 | 3.63 | 32.58 | 11.94 | 0.86 | 0.79 | 1.82 | 0.80 | 7.70 | |

| -value | 0.000 | 0.004 | 0.000 | 0.001 | 0.464 | 0.557 | 0.165 | 0.498 | 0.000 |

| 0.345 | 0.146 | 0.192 | 0.083 | 0.033 | 0.028 | 0.025 | 0.019 | 0.460 | |

| Sample (before weighting) | 159 | 131 | 153 | 161 | 152 | 150 | 157 | 107 | 118 |

Note: Coefficient = beta coefficient; *; **; and ***.

Variable Measurement Considerations

| Variable | Correlation, | Simple linear regression coefficient | |

|---|---|---|---|

| Building damage () | |||

| Percentage (based on damage state) | 0.518*** | 0.022*** | 0.268 |

| Indicator (1 = damaged, 0 = not damaged) | 0.339*** | 0.896*** | 0.115 |

| Contents damage () | |||

| Percentage (based on damage state) | 0.429*** | 0.017*** | 0.280 |

| Indicator (1 = damaged, 0 = not damaged) | 0.472*** | 1.205*** | 0.223 |

| Machinery damage () | |||

| Percentage (based on damage state) | 0.584*** | 0.026*** | 0.300 |

| Indicator (1 = damaged, 0 = not damaged) | 0.522*** | 1.850*** | 0.273 |

| Electricity loss () | |||

| Duration of outage (log days) | 0.513*** | 0.969*** | 0.263 |

| Indicator (1 = lost, 0 = not lost) | 0.021 | 0.198 | 0.000 |

| Water loss () | |||

| Duration of outage (log days) | 0.276*** | 0.375*** | 0.076 |

| Indicator (1 = lost, 0 = not lost) | 0.059 | 0.260 | 0.003 |

| Gas loss () | |||

| Duration of outage (log days) | 0.343*** | 0.586*** | 0.118 |

| Indicator (1 = lost, 0 = not lost) | 0.357*** | 1.765*** | 0.127 |

| Sewer loss () | |||

| Duration of outage (log days) | 0.238** | 0.224*** | 0.056 |

| Indicator (1 = lost, 0 = not lost) | 0.096 | 0.264 | 0.009 |

| Cell loss () | |||

| Duration of outage (log days) | 0.158 | 0.214 | 0.025 |

| Indicator (1 = lost, 0 = not lost) | 0.001 | 0.001 | 0.000 |

| Maximum disruption (, ) | |||

| Maximum damage state (DS1–DS5) | 0.528*** | 0.016*** | 0.261 |

| Maximum utility loss (log days) | 0.566*** | 0.566*** | 0.179 |

Note: Coefficient = beta coefficient from simple regression model; *; **; and ***.

| Variable | Model 10 (restricted) | Model 11 (unrestricted) | Model 12 (unrestricted) | Model 13 (restricted) | Model 14 (unrestricted) | Model 15 (unrestricted) |

|---|---|---|---|---|---|---|

| Coefficient | Coefficient | Coefficient | Coefficient | Coefficient | Coefficient | |

| Constant | 1.494 | 1.371 | 0.428 | 1.483 | 0.526 | — |

| Damage indicator | ||||||

| Building (1/0) | 0.194 | 0.165 | 0.128 | — | — | — |

| Contents (1/0) | 0.644** | 0.655*** | 0.504** | — | — | — |

| Machinery (1/0) | 1.351*** | 1.135*** | 0.825** | — | — | — |

| Percentage damage (%) | ||||||

| Building | — | — | — | 0.010*** | 0.010*** | 0.009*** |

| Contents | — | — | — | 0.008*** | 0.008*** | 0.006** |

| Machinery) | — | — | — | 0.012*** | 0.010*** | 0.007** |

| Utility loss indicator | ||||||

| Electricity (1/0) | — | 0.032 | — | — | 0.139 | — |

| Water (1/0) | — | 0.115 | — | — | 0.162 | — |

| Gas (1/0) | — | 1.209*** | — | — | 0.970** | — |

| Sewer (1/0) | — | — | — | — | ||

| Cell (1/0) | — | — | — | — | ||

| Log days of utility loss | ||||||

| Electricity (log days) | — | — | 0.453** | — | — | 0.435** |

| Water (log days) | — | — | 0.113 | — | — | 0.126 |

| Gas (log days) | — | — | 0.271** | — | — | 0.189 |

| Sewer (log days) | — | — | 0.023 | — | — | |

| Cell (log days) | — | — | 0.094 | — | — | 0.087 |

| 14.19 | 7.99 | 13.10 | 30.00 | 12.71 | 15.85 | |

| -value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| 0.320 | 0.381 | 0.427 | 0.397 | 0.436 | 0.480 | |

| Change in | — | 0.061 | 0.107 | — | 0.039 | 0.083 |

| Partial -statistic | — | 1.63 | 3.92 | — | 1.13 | 3.14 |

| Partial -statistic -value | — | 0.157 | 0.003 | — | 0.349 | 0.011 |

| sample (before weighting) | 127 | 127 | 127 | 127 | 127 | 127 |

Note: coefficient = beta coefficient; *; **; and ***.

| Variable | Model 16 (restricted) | Model 17 (unrestricted) | Model 18 (unrestricted) | Model 19 (restricted) | Model 20 (unrestricted) | Model 21 (unrestricted) |

|---|---|---|---|---|---|---|

| Coefficient | Coefficient | Coefficient | Coefficient | Coefficient | Coefficient | |

| Constant | 1.655 | 1.371 | 0.526 | 0.157 | 0.428 | — |

| Utility loss indicator | ||||||

| Electricity (1/0) | 0.020 | 0.032 | 0.139 | — | — | — |

| Water (1/0) | 0.187 | 0.115 | 0.162 | — | — | — |

| Gas (1/0) | 1.746*** | 1.209*** | 0.970** | — | — | — |

| Sewer (1/0) | 0.090 | — | — | — | ||

| Cell (1/0) | — | — | — | |||

| Log days of utility loss | ||||||

| Electricity (log days) | — | — | — | 0.691*** | 0.453** | 0.435 |

| Water (log days) | — | — | — | 0.159 | 0.113 | 0.126 |

| Gas (log days) | — | — | — | 0.367*** | 0.271** | 0.189 |

| Sewer (log days) | — | — | — | 0.087 | 0.023 | |

| Cell (log days) | — | — | — | 0.118 | 0.094 | 0.087 |

| Damage indicator | ||||||

| Building (1/0) | — | 0.165 | — | — | 0.128 | — |

| Contents (1/0) | — | 0.655*** | — | — | 0.504** | — |

| Machinery (1/0) | — | 1.135*** | — | — | 0.825** | — |

| Percentage damage (%) | ||||||

| Building | — | — | 0.010*** | — | — | 0.009*** |

| Contents | — | — | 0.008*** | — | — | 0.006** |

| Machinery | — | — | 0.010*** | — | — | 0.007** |

| 3.15 | 7.99 | 12.71 | 12.77 | 13.10 | 15.85 | |

| -value | 0.010 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| 0.142 | 0.381 | 0.436 | 0.318 | 0.427 | 0.480 | |

| Change in | — | 0.239 | 0.294 | — | 0.109 | 0.162 |

| Partial -statistic | — | 15.05 | 26.29 | — | 5.20 | 12.56 |

| Partial -statistic -value | — | 0.000 | 0.000 | — | 0.002 | 0.000 |

| Sample (before weighting) | 127 | 127 | 127 | 127 | 127 | 127 |

Note: Coefficient = beta coefficient; *; **; and ***.

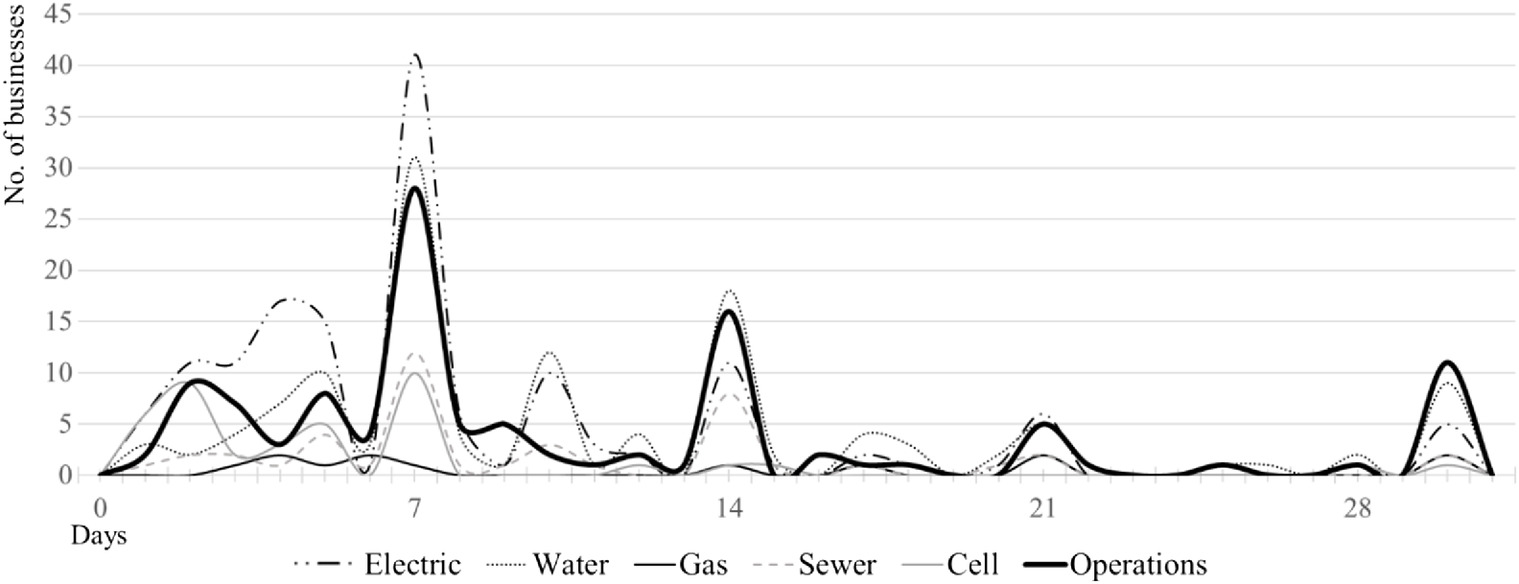

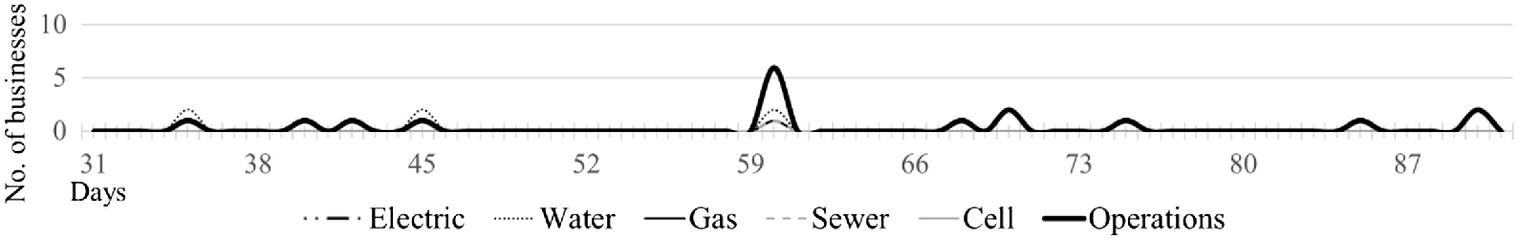

Time Considerations

| Variable | Open at 1 week (45% of sampled businesses open) | Open at 2 weeks (71% of sampled businesses open) | Open at 3 weeks (81% of sampled businesses open) | Open at 4 weeks (85% of sampled businesses open) | Open at 5 weeks (90% of sampled businesses open) | Open at 6 weeks (91% of sampled businesses open) |

|---|---|---|---|---|---|---|

| Building (1/0) | *** | *** | *** | *** | *** | *** |

| Contents (1/0) | *** | *** | *** | *** | *** | *** |

| Machinery (1/0) | *** | *** | *** | *** | *** | *** |

| Building (%) | *** | *** | *** | *** | *** | *** |

| Contents (%) | *** | *** | *** | *** | *** | *** |

| Machinery (%) | *** | *** | *** | *** | *** | *** |

| Electric (initial) | 0.005 | 0.042 | 0.065 | 0.098 | 0.104 | |

| Water (initial) | 0.020 | 0.072 | 0.080 | |||

| Gas (initial) | ** | *** | ** | ** | *** | *** |

| Sewer (initial) | 0.009 | 0.014 | ||||

| Cell (initial) | 0.066 | 0.045 | 0.029 | 0.003 | ||

| Electric (in period) | *** | *** | *** | ** | ||

| Water (in period) | ** | ** | *** | * | ||

| Gas (in period) | *** | *** | ** | ** | ** | ** |

| Sewer (in period) | ** | ** | ** | ** | * | |

| Cell (in period) | ||||||

| Customer loss (%) | * | * | * | * | * | |

| Access | *** | *** | *** | *** | *** | *** |

Note: *; **; and ***.

| Variable | Model 22 |

|---|---|

| Coefficient | |

| Constant | 0.182 |

| Percentage damage (%) | |

| Building | 0.010*** |

| Contents | 0.004 |

| Machinery | 0.007** |

| Log days of utility loss | |

| Electricity (log days) | 0.351* |

| Water (log days) | 0.105 |

| Gas (log days) | 0.135 |

| Sewer (log days) | |

| Cell (log days) | 0.145 |

| Transportation disruption | |

| Access | 0.435** |

| Customer issues | |

| Customers | 0.483*** |

| 12.00 | |

| -value | 0.000 |

| 0.542 | |

| Sample (before weighting) | 118 |

Note: Coefficient = beta coefficient; *; **; and ***.

Discussion and Conclusions

Data Availability Statement

Acknowledgments

References

Information & Authors

Information

Published In

Copyright

History

ASCE Technical Topics:

- Business management

- Data analysis

- Disaster risk management

- Disasters and hazards

- Economic factors

- Engineering fundamentals

- Field tests

- Hurricanes, typhoons, and cyclones

- Infrastructure

- Lifeline systems

- Measurement (by type)

- Methodology (by type)

- Metric systems

- Natural disasters

- Practice and Profession

- Research methods (by type)

- Social factors

- Tests (by type)

- Utilities