Introduction and Background

Flooding is the most costly natural disaster in the US; floods were responsible for $ 8t billion in economic losses annually from 2000 to 2019 (

Smith 2020). The economic costs associated with floods have increased substantially in recent decades within the US and are anticipated to increase further in the future due to the combined effects of urbanization (

Cutter et al. 2018) and a changing climate that includes impacts such as sea level rise and an intensification of the hydrologic cycle (

Hayhoe et al. 2018). As such, it is anticipated that the importance of flood risk management will increase in the future (

Van Ootegem et al. 2015).

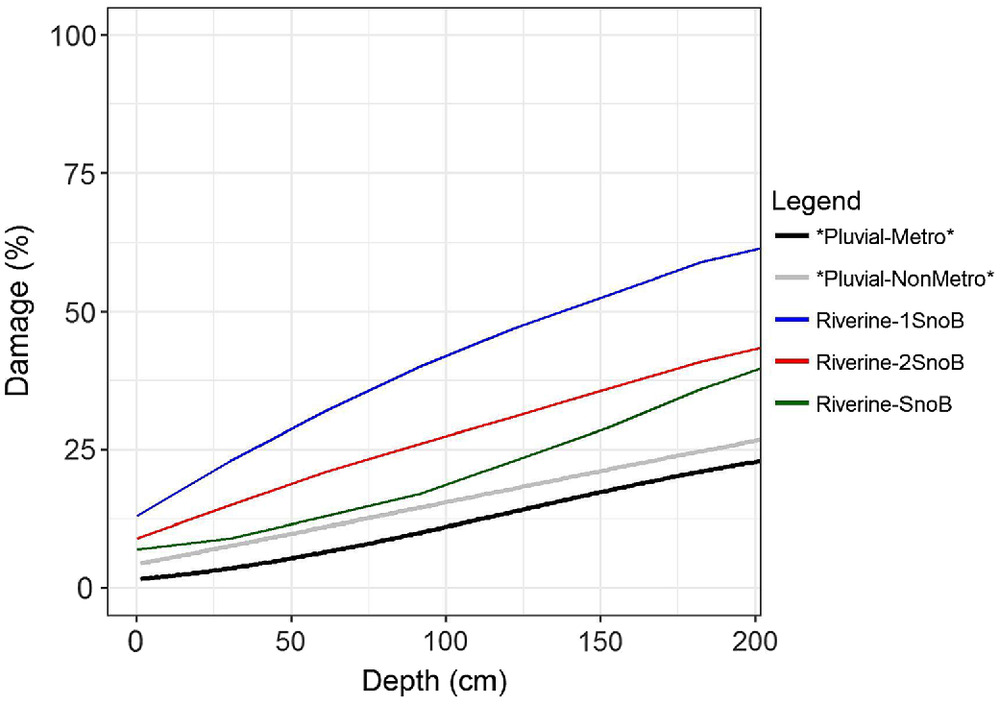

An essential component of flood risk management is quantifying future economic flood losses to inform decision makers (e.g., government officials) of the locations that are the most at risk. Currently, depth–damage functions are typically used for these analyses, which are designed to relate building or content damage—relative or absolute—to flood depths (e.g., US Army Corps of Engineers (

USACE 2019). Although these functions are widely used to estimate damage associated with coastal and riverine (i.e., fluvial) flooding, depth–damage functions for pluvial, or rainfall-related flooding, are not widely available.

In general, pluvial flooding occurs when high-intensity rainfall results in precipitation accumulation that exceeds the capacity of natural and engineered drainage systems to absorb water or carry it away. Unlike riverine and coastal flooding, pluvial flooding can occur in locations far away from bodies of water. Additionally, pluvial flooding is particularly, and increasingly, challenging to major cities and urban areas characterized by growing populations, impervious surfaces, and aging drainage systems (

National Academies of Sciences, Engineering, and Medicine 2019).

Historically, pluvial flood risk has not been well-understood. This is partly due to the complex topographic and drainage dynamics required to accurately model the hazard. Rainfall events that result in pluvial flooding are also difficult to monitor because these events can occur over short time frames and small spatial scales (

Rosenzweig et al. 2018). As such, pluvial flood risk has typically been excluded from flood risk analyses (

National Academies of Sciences, Engineering, and Medicine 2019). For example, FEMA’s Flood Insurance Rate Maps (FIRMs), which are the most widely used flood risk assessment and communication tools in the US, exclude pluvial flood risk. As a result of this exclusion, Wing et al. (

2018) concluded that the inadequate assessment of pluvial flood risk in urban areas has caused FEMA to significantly underestimate the population exposed to flood risk. As a result, many households and communities at risk of pluvial flooding are unaware of it and of the potential economic losses associated with flooding.

Although greater economic damage generally results from a singular riverine or coastal flooding event when compared with a singular pluvial event, the occurrence of riverine and coastal events are relatively rare compared with pluvial events. Over long time frames, research indicated that the cumulative damage associated with pluvial floods is comparable to that of riverine flooding (

Zhou et al. 2012). Recent events illustrate the importance of understanding the economic risks associated with pluvial flooding. For example, Hurricane Harvey (2017)—a predominantly pluvial event—dropped more than 150 cm (60 in.) rain on the Houston, Texas, area. The storm killed 68 people and resulted in $125 billion in damages (

Blake and Zelinsky 2018). In July 2016, 150 cm (60 in.) of rain fell on Ellicott City, Howard County, Maryland, resulting in flash floods that caused more than $22 million in damages. Less than 2 years later, in May 2018, the city was impacted by a 1-in-1,000-year event in which successive thunderstorms poured 20 cm (8 in.) of rain on the city in just 3 h (

Viterbo et al. 2020). The development of depth–damage functions for pluvial flooding could assist stakeholders in providing a more comprehensive view of future flood damage in the US.

Recent research has focused on the development of damage models for pluvial flooding; however, progress has been hindered by the availability of pluvial flood risk data and the lack of damage records for pluvial events (e.g.,

Van Ootegem et al. 2015;

Rözer et al. 2019). Van Ootegem et al. (

2015) developed multivariate models using self-reported (i.e., survey) hazard (i.e., flood depths) and nonhazard (e.g., structure type) data to predict building-level economic loss from pluvial flooding in Belgium. Their results indicated that although inundation depth is the most important predictor of damage, nonhazard data are important predictors of economic damage from pluvial flooding (

Van Ootegem et al. 2015). In a similar study, Rözer et al. (

2019) used survey data to develop probabilistic multivariable models to estimate pluvial flood losses to buildings in Harris County, Texas, impacted by Hurricane Harvey. In agreement with Van Ootegem et al. (

2015), the results of Rözer et al. (

2019) indicated that the inclusion of nonhazard data reduced the magnitude of uncertainty in flood loss estimates. Although the results of these studies indicate increased utility of depth–damage models by including nonhazard data, both studies noted that this type information is not available for broader scale analyses, and the efficacy of their models is unknown for other regions (

Van Ootegem et al. 2015;

Rözer et al. 2019).

Given the lack of available data needed for the development of pluvial damage models, several studies have attempted to adapt fluvial depth–damage functions to estimate pluvial flood damage by combining them with the output of urban drainage models (e.g.,

Freni et al. 2010;

Olsen et al. 2015;

Zhou et al. 2012). However, the utility of coastal and fluvial functions for understanding economic risk from pluvial flooding remains unclear (e.g.,

Kellens et al. 2013). Pluvial floods are generally characterized by shorter duration and slower water velocities when compared with fluvial floods (

ten Veldhuis 2011). As such, using a curve developed for fluvial flooding to estimate damage for pluvial flooding could lead to systematic biases in loss estimates.

Recently released flood risk data from the First Street Foundation’s flood model (i.e.,

Bates et al. 2020) provide probabilistic estimates of pluvial flood risk (in addition to fluvial, tidal, and surge risk) for every property parcel in the contiguous US. Given the high spatial resolution of these data, researchers and practitioners can not only communicate pluvial risk at finer spatial scales, but also use these data to estimate expected flood damages at the property level, as Armal et al. (

2020) have done for fluvial and coastal flood damages in New Jersey. Additionally, computational advancements have made it possible to examine a large historical claims database, which contains building-level damage assessments and inundation depths, at relatively little computational cost. Therefore, the research presented here aims to contribute to the body of research examining the economic risks associated with pluvial flooding within the US by developing univariate depth–damage functions for pluvial flooding. A secondary goal is to measure external validity through demonstrating the utility of these functions by applying them to areas within the state of New Jersey. For this, an automated valuation model (AVM) was developed to compute building value estimates, which were then used in conjunction with pluvial flood hazard layers and the study-developed depth–damage functions to estimate the annual economic impact from pluvial flooding to buildings within the state. It is anticipated that when combined with recently released flood hazard data, the study-developed pluvial depth–damage functions will afford more holistic economic risk analyses of flood exposure within the contiguous US.

Discussion and Conclusions

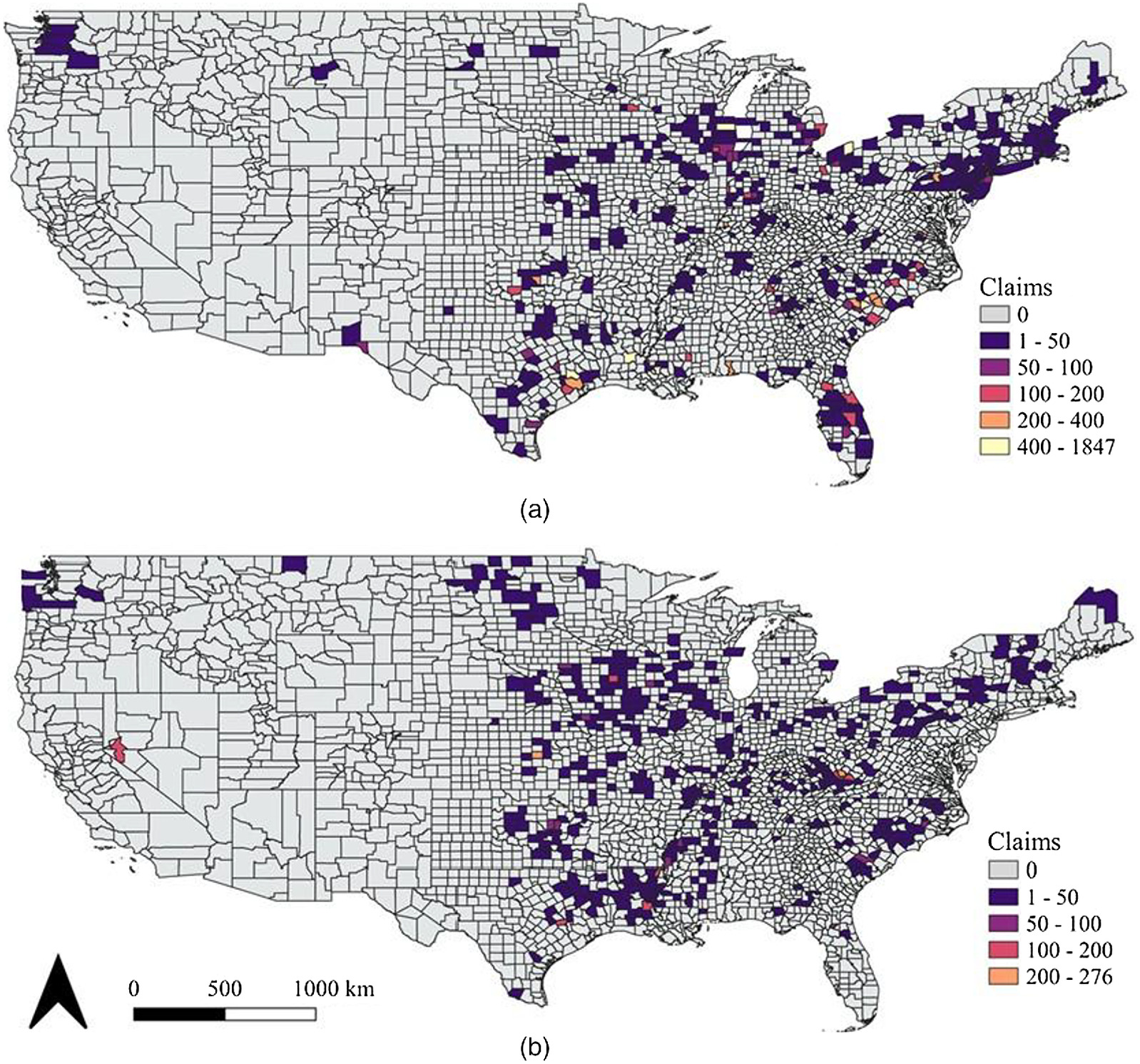

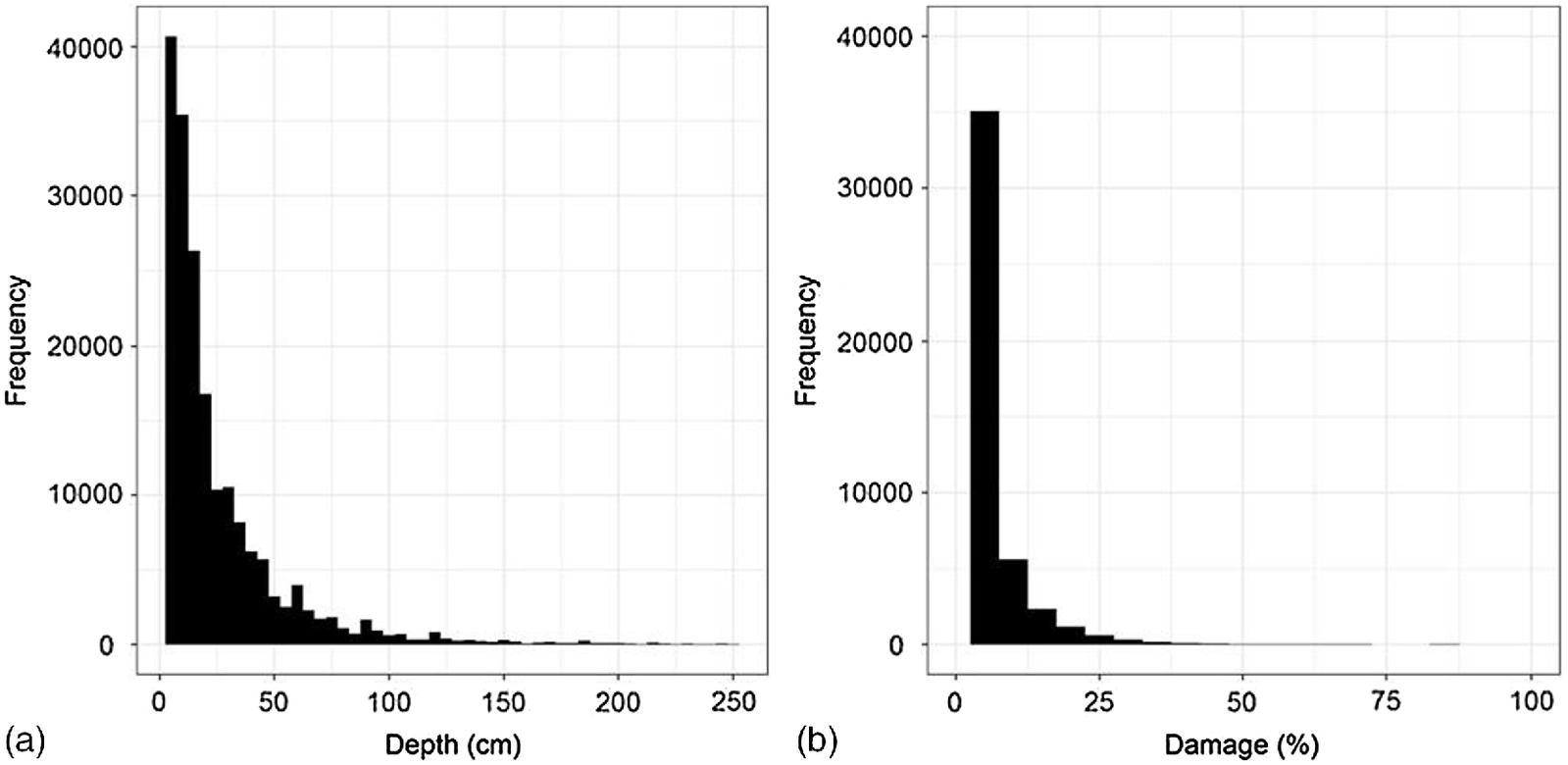

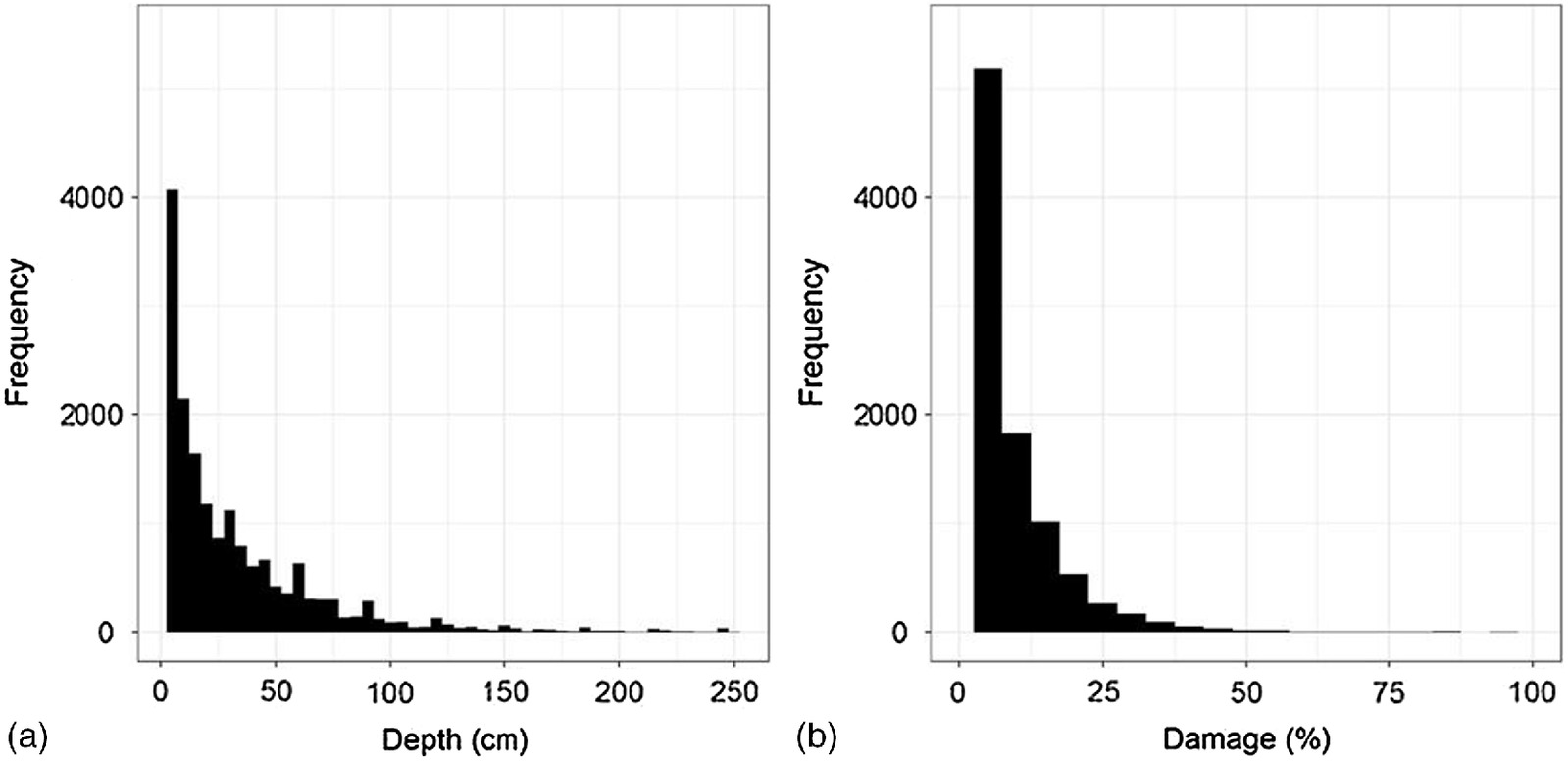

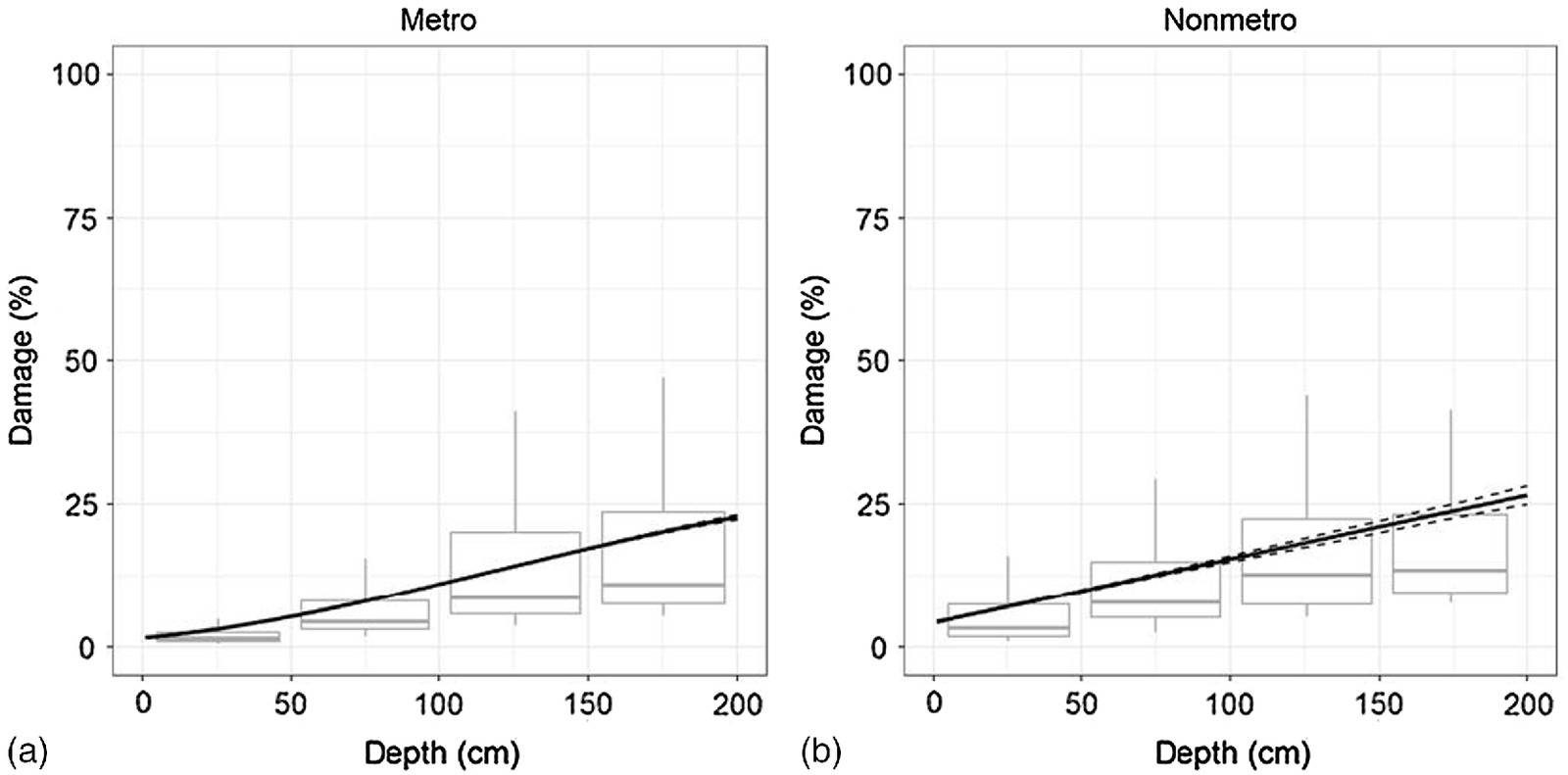

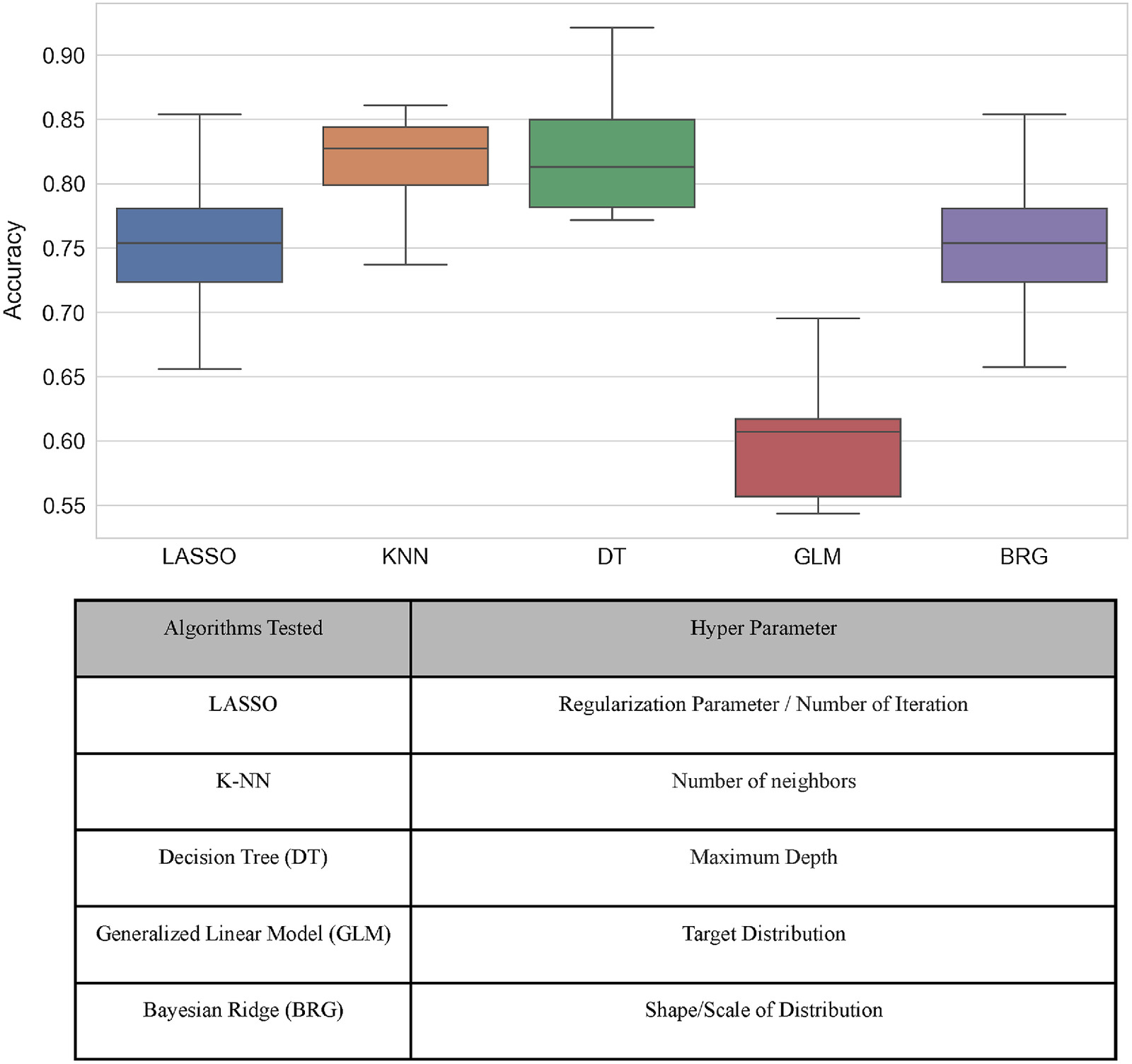

The primary objective of this study was to develop pluvial depth–damage functions using existing historical insurance/damage payout data. Within this study, building-level complexity for the damage functions could not be produced due to the lack of adequate property-level differentiation. However, it was found that reliable differentiation does exist between metropolitan and nonmetropolitan contexts. For both the metropolitan and claims data sets, a polynomial regression model was selected over a simple linear model to characterize the depth–damage function. The metropolitan polynomial model explained 23% of the variance. This is in line with the results of the multivariate models developed by Van Ootegem et al. (

2015), which explained 18% and 28%. Although Van Ootegem et al. (

2015) used multiple predictors within their models, the similar results of the simpler metropolitan model developed here may be explained by the role of flood depth as the most important predictor of damage. In contrast, the nonmetropolitan model developed here explained 14% of the damage variance, which is less than that of the models developed by Van Ootegem et al. (

2015). This difference may be because the Van Ootegem et al. (

2015) damage models were developed using a survey data set from an urban environment.

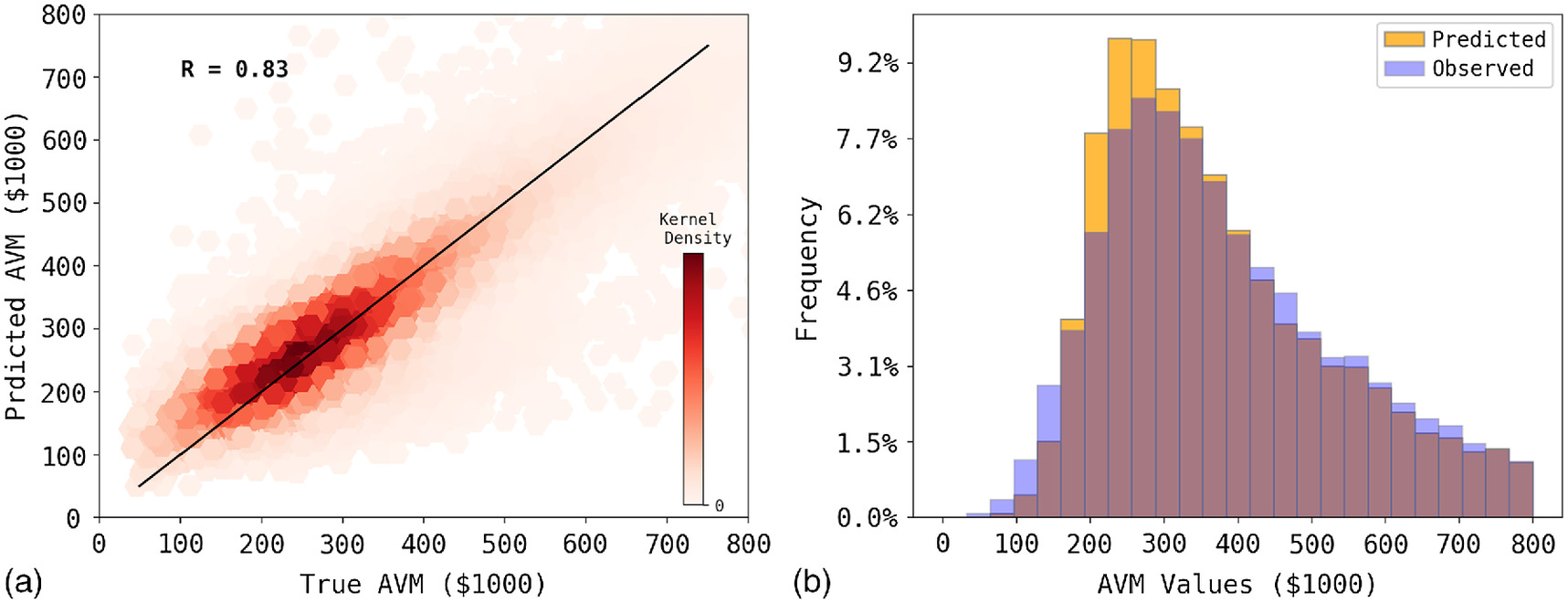

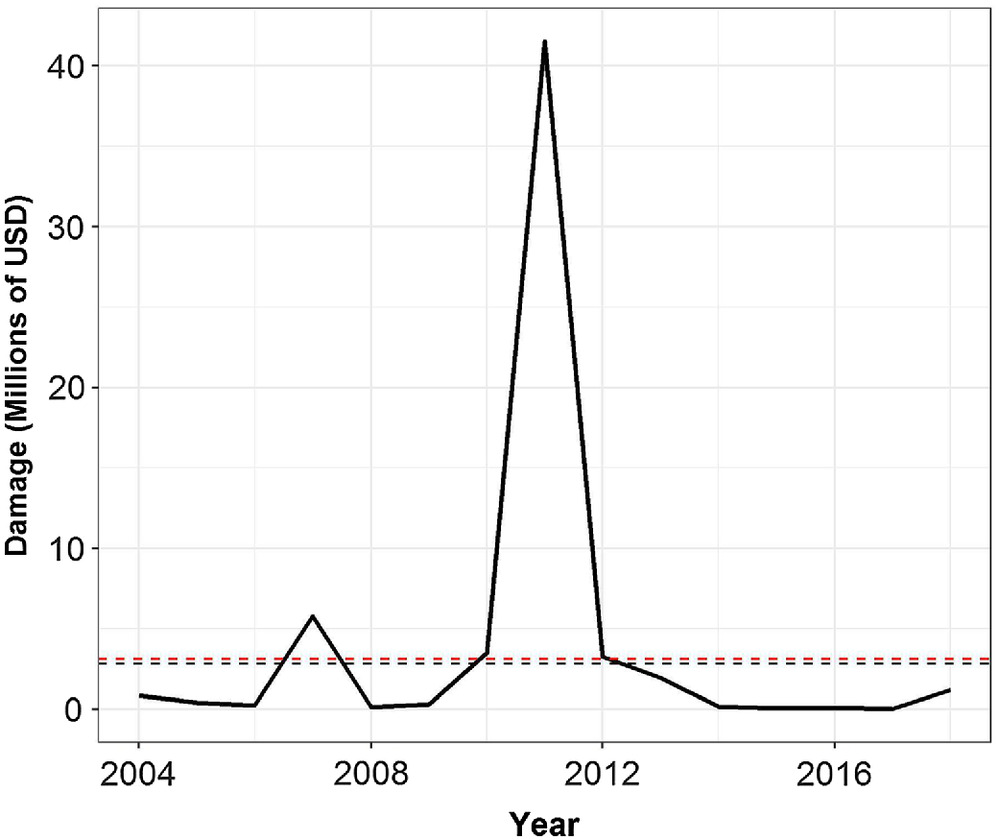

A secondary objective of this study was to test the utility of the developed depth–damage functions. Because the functions developed here are relative (in percent form), an AVM was developed to obtain an economic value for each property within the state of New Jersey. The building values of those properties were estimated as the replacement cost of structure on the property. These were then combined with pluvial-only flood hazard layers and the derived depth–damage functions to compute an annualized loss estimate for the portion of economic risk in New Jersey resulting from expected pluvial flooding on an annual basis. It is clear that the pluvial damage functions deviated significantly from the damage function in the HAZUS framework, which reflect coastal and riverine damage based on observations related to water depth in prior USACE studies (Fig.

8). Additionally, a comparison of the expected flood economic damage in both 2020 and 2050 aligned with the observed payouts during the 2004–2018 time period (when accounting for the higher average over the period due to the anomaly of high payouts in 2011) (Fig.

7).

Further research is needed to refine the pluvial depth–damage functions developed here. However, our results prove that the depth–damage relationship for pluvial flooding is likely to be different from that for other flood types (e.g., fluvial). This was illustrated by our New Jersey case study. Additionally, although the norm is to apply riverine and coastal damage functions, these do not capture the full expectation of annualized economic loss. Although New Jersey is situated along the coast, about half of the properties at risk of flooding within the current environmental context are at risk of pluvial-only hazards. Although pluvial-only hazards are not as economically damaging as coastal and riverine flood hazards, they tend to affect a larger proportion of properties in the US. As such, the economic impacts of these hazards cannot be ignored. Future research on the economic risk associated with flooding will benefit from the inclusion of pluvial flood risk.